New FEMA Export-Import Regulations 2026: What Every Business Needs to Know

- Finsync Solutions

- Jan 22

- 5 min read

Introduction

On January 13, 2026, the Reserve Bank of India issued a comprehensive overhaul of India's foreign exchange regulations governing exports and imports. The Foreign Exchange Management (Export and Import of Goods and Services) Regulations, 2026 represents the most significant consolidation of trade compliance rules in recent years, and it's set to take effect on October 1, 2026.

If your business exports goods or services, imports materials, or engages in cross-border trade, these changes will impact your compliance obligations, reporting timelines, and operational processes.

What Was Wrong with the Old Framework?

Before January 13, 2026, India's foreign exchange regulations for trade were fragmented across multiple instruments.

Multiple RulebooksExports were governed by the Foreign Exchange Management (Export of Goods and Services) Regulations, 2015, while imports followed separate guidelines. Services exports existed in a regulatory grey zone with unclear reporting expectations.

Inconsistent TimelinesExport realisation periods and reporting deadlines varied across categories. While recent amendments extended the export proceeds realisation timeline from 9 months to 15 months, this was done through piecemeal circulars rather than a unified framework.

Fragmented ReportingCompliance relied on EDPMS (Export Data Processing and Monitoring System) and IDPMS (Import Data Processing and Monitoring System), but guidance wasn't uniformly strict across banks. Service exports weren't always pulled into standard reporting flows as cleanly as goods.

In short, the old system was workable but not streamlined. It created compliance complexity where simplicity should have existed.

What Changed on January 13, 2026?

The new regulations address these fragmentation issues head-on by creating a unified regulatory framework for all trade-related foreign exchange compliance.

1. One Framework for Exports, Imports, and Services

Instead of separate rules scattered across multiple instruments, everything now falls under the Foreign Exchange Management (Export and Import of Goods and Services) Regulations, 2026.

What this means: Exporters and importers now have a single reference point for compliance, services exports are explicitly included in the reporting framework, and regulatory expectations are clearer and more consistent.

2. Stricter Reporting Timelines

While the new framework simplifies the regulatory structure, it introduces tighter reporting discipline.

Key Change: Authorized dealer banks must upload export and import declarations into EDPMS/IDPMS within five working days of receipt for non-EDI ports. This is a significant tightening from previous practices where reporting windows were less defined.

Why this matters: Faster reporting means RBI can monitor cross-border flows more effectively and identify compliance gaps sooner. For businesses, it means tighter coordination with your authorized dealer banks and internal processes that can't afford delays.

3. Services Exports Explicitly Covered

One of the biggest gaps in the old framework was the unclear treatment of services exports. The new regulation fixes this by bringing service exports into the same reporting framework as goods exports, with clear expectations on when declarations must be furnished relative to invoice issuance or payment receipt.

4. Enhanced Compliance Oversight

The new regulations consolidate and supersede older master directions and circulars, clarifying regulatory expectations across the board. Authorized dealers now have explicit legal duties under FEMA and RBI directions, must report suspicious or delayed transactions, and ensure strict alignment with Foreign Trade Policy and customs context. Digital systems (EDPMS/IDPMS) become the backbone of compliance monitoring.

5. Extended Export Realisation Period (But With Conditions)

The good news: The export proceeds realisation period remains extended at 15 months (up from the traditional 9 months).

The trade-off: While you have more time to realise export proceeds, the reporting and declaration timelines are getting stricter. You get flexibility on realisation but must maintain tighter discipline on documentation and reporting.

Why RBI Made These Changes

The consolidated framework reflects RBI's broader push toward:

Digital Compliance Infrastructure: Real-time monitoring through EDPMS/IDPMS allows better oversight of cross-border flows, reducing compliance risk and enabling faster identification of irregularities.

Ease of Doing Business: By consolidating multiple regulations into one, RBI is reducing the complexity businesses face. One rulebook is easier to navigate than multiple fragmented circulars.

Stronger Regulatory Oversight: Tighter reporting timelines and explicit service export coverage give RBI better visibility into India's trade flows.

Closing Regulatory Gaps: The inclusion of services exports and clearer expectations for authorized dealers address long-standing ambiguities.

What This Means for Your Business

If You're an Exporter (Goods or Services)

What's Better: One consolidated regulation to reference, extended realisation period (15 months), and clear reporting expectations for service exports.

What's Stricter: Export declarations must be uploaded within 5 working days, real-time monitoring means less room for delayed reporting, and authorized dealers have stricter obligations.

Action Items:

Review your current export documentation process

Ensure your authorized dealer bank is aligned with the new timelines

If you export services, clarify your reporting obligations under the new framework

Prepare internal teams for faster declaration cycles

If You're an Importer

What's Better: Consolidated compliance framework and clear expectations across all import categories.

What's Stricter: Import declarations must be uploaded within defined windows, and coordination with customs and authorized dealers becomes more time-sensitive.

Action Items:

Audit your import compliance processes

Ensure alignment with your authorized dealer's new obligations

Prepare for faster reporting cycles starting October 2026

If You're an Authorized Dealer (Bank)

What's Changing: Legal obligations under FEMA are now more explicit, 5-day upload windows for declarations are mandatory, suspicious or delayed transactions must be reported, and digital integration with EDPMS/IDPMS is non-negotiable.

Key Deadlines You Need to Know

January 13, 2026: RBI issued the new regulationsOctober 1, 2026: The new regulations take effectBetween Now and October 2026: Transition period to update processes and prepare teamsPost-October 2026: 5-day upload requirement becomes mandatory

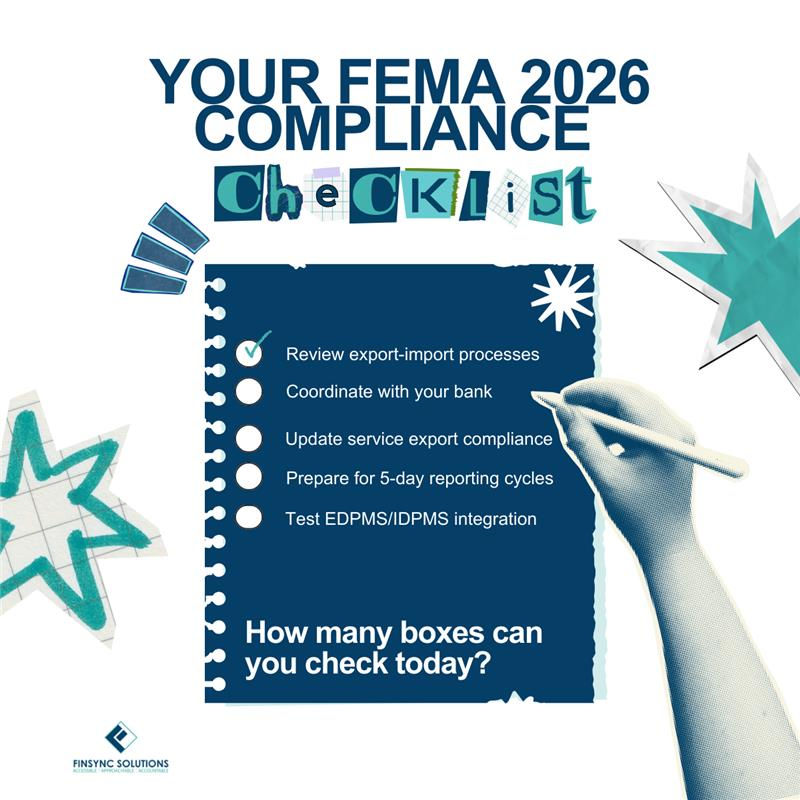

Your FEMA 2026 Compliance Checklist

☐ Review current export-import processes and identify gaps

☐ Coordinate with authorized dealer banks on new timelines

☐ Update service export compliance procedures

☐ Prepare teams for faster reporting cycles

☐ Test EDPMS/IDPMS integration

☐ Mark October 1, 2026 on your calendar

Common Questions About the New FEMA Framework

Q: Do these regulations apply to all exporters and importers?Yes. If you're engaged in cross-border trade of goods or services, the new regulations apply to you.

Q: What happens if I don't comply by October 1, 2026?Non-compliance with FEMA regulations can result in penalties, regulatory scrutiny, and potential delays in your trade operations.

Q: Is the 15-month export realisation period guaranteed?The 15-month period is the standard timeline under the new framework, but it's subject to RBI directions and may vary based on specific circumstances. Always confirm with your authorized dealer.

Q: How does this impact service exporters specifically?Service exporters now have clear reporting obligations that align with goods exports. You'll need to furnish declarations relative to invoice issuance or payment receipt, and ensure compliance with the same EDPMS reporting timelines.

How Finsync Solutions Can Help

Regulatory transitions like this don't happen overnight. They require strategic planning, process updates, team training, and coordination with multiple stakeholders.

At Finsync Solutions, we specialize in helping businesses navigate complex regulatory changes:

FEMA Compliance Advisory: We help you understand the new regulations and build compliance frameworks that work

Export-Import Process Optimization: We ensure your operations align with new requirements without disrupting trade flows

Authorized Dealer Coordination: We work with your banks to ensure seamless integration with new reporting timelines

Service Export Compliance: We help clarify your obligations and ensure your reporting processes meet new standards

Training and Transition Support: We prepare your teams through targeted training and hands-on support

Final Thoughts

The new FEMA Export-Import Regulations represent a significant step forward in India's trade compliance landscape. By consolidating fragmented rules into one unified framework, RBI is making compliance easier to understand, even if the reporting timelines are getting stricter.

For businesses, the message is clear: prepare now, not later.

October 2026 might seem far away, but implementing compliance changes, coordinating with banks, and training teams takes time. The businesses that start preparing today will transition smoothly. The ones that wait until September will be scrambling.

Your trade operations are too important to leave compliance to the last minute.

Need help navigating the new FEMA framework?

Finsync Solutions provides strategic compliance support for businesses engaged in cross-border trade. We'll help you prepare for October 2026 so regulatory changes don't disrupt your operations.

.png)

Comments